State Bank Of India Fixed Deposit Rates

India’s largest lender State Bank of India offers eight maturity options for retail fixed deposits, or fixed deposits up to Rs 2 crore. The maturity period starts at seven days and extends to as long as 10 years.

- What Is The Fd Rate Of Sbi

- State Bank Of India Fixed Deposit Rates 2019

- State Bank Of India Fixed Deposit Rates 2020

- State Bank Of India Fixed Deposit Rates

- State Bank Of India Fixed Deposit Rates 2018

SBI offers interest rates of 2.9 percent to 5.4 percent to its general depositors and 3.4 percent to 6.2 percent to its senior citizens’ customers on retail FDs.

SBI changes interest rates from time to time on the basis to align them with benchmark rates. These interest rates are effective from September 10.

- Interest Rates 6.70%. p.a. Fixed Deposit Fixed Deposit More Information. State Bank of India wants you to be secure. If you come across any.

- The largest Indian commercial bank, State Bank of India (SBI), has revised its fixed deposit (FD) interest rates in select maturity tenures. SBI FD offers a number of benefits to investors such as.

- The State Bank of India is the largest Indian bank with 42 crore customers. It offers a wide list of products and services to customers including savings accounts, fixed deposits, loans and credit cards. It has been ranked as 236th in the Fortune Global 500 list of the world's biggest corporations of 2019.

- State Bank of India Short-term Fixed Deposit Rates: The interest rates offered by the bank for the short-term deposits range in-between 5.5% to 6.5% per annum. The shortest-term for fixed deposit offered by the bank is one month for which the returns are pegged at 5.5% per annum.

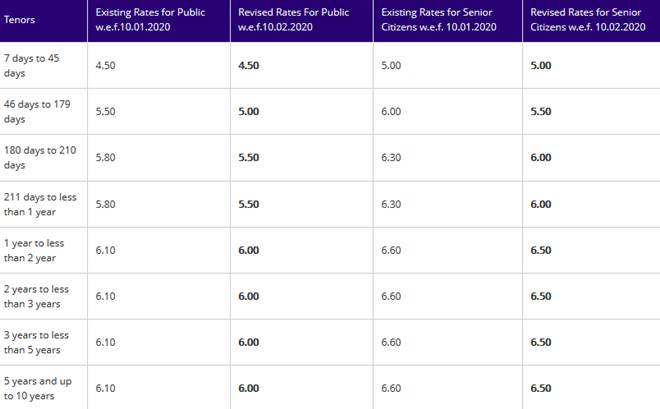

Check out SBI fixed deposit rates:

Maturity Period

General

Exchange Rate Safe Deposit Locker Business Banking. Business Current Account. Cash ISA Fixed Deposit Account Grow your saving, tax free. Home Personal Banking. SUB Services How to open an account with the State Bank of India UK Ltd. How to open an account with SBI UK Ltd.

Senior Citizen

7 days to 45 days

2.9%

3.4%

46 days to 179 days

3.9%

4,4%

180 days to 210 days

4.4%

4.9%

211 days to 365 days

4.4%

4.9%

1 year to 2 years

4.9%

5.4%

2 years to 3 years

5.1%

5.6%

3 years to 5 years

5.3%

5.8%

5 years to 10 years

5.4%

6.2%

Source: sbi.co.on

India’s largest private sector lender HDFC Bank on fixed up Rs 2 crore, 12 maturity options are offered with varied interest rates by HDFC Bank. Maturity period starts from 7 days up to 10 years. Bank provides 2.5 percent for 7 to 14 days to general customers and an additional 0.5 percent to senior citizens on fixed deposits. HDFC Bank revised its interest rates on fixed deposits with effect from November 13, 2020.

Maturity Period

General

Senior Citizens

7-14 days

2.5%

3%

15-29 days

2.5%

3%

30-45 days

3%

3.5%

46-60 days

3%

3.5%

61-90 days

3%

3.5%

91 days – 6 months

3.5%

4%

6 months – 9 months

4.40%

4.90%

1 year 1 day – 2 years

4.90%

5.40%

2 years 1 day – 3 years

5.15%

What Is The Fd Rate Of Sbi

5.65%

3 years 1 day – 5 years

5.30%

5.80%

5 years 1 day – 10 years

5.50%

6.25%

Source: HDFC Bank website

Recommended for you

State Bank Of India Fixed Deposit Rates 2019

- Extremely competitive interest rates

- Variety of CD terms and accounts available

- High minimum deposit

- Limited physical locations

- Residents of New York looking for great rates

State Bank of India New York (SBI) is just one of the many overseas offices established under the original, Mumbai-based financial institution. Founded in 1806, State Bank of India currently offers more than 22,000 branches in India and operates 195 overseas offices. The New York office, which was founded in 1970, offers a variety of banking products. In addition, the office specializes in corporate credit, trade finance, and deposits and remittances. The bank’s deposit focus area covers products like checking accounts, money market accounts and certificate of deposit (CD) accounts. Furthermore, SBI’s CDs, which offer some of the best CD rates, come with terms ranging from three months to five years. They additionally branch into three different categories: Retail, Corporate and Senior Citizen certificates.

If you’re looking for more convenient banking options, SBI also offers an online banking feature. Through SBI’s online banking service, you can fulfill basic actions like opening accounts, making deposits or completing transfers.

SBI Retail Certificates

SBI’s Retail certificates function as the bank’s standard CD accounts. With terms from three months to five years, the Retail certificates require a $5,000 minimum to open. Additionally, the bank requires $5000 minimum for personal, U.S. based consumer accounts, while they require $10,000 for accounts of businesses. All Retail CD terms produce competitive interest rates. So if you don’t mind the $5,000 minimum, then you could significantly grow your wealth with a SBI account.

| Retail CD | Minimum Deposit | APY | |

| 3 Month | $5,000 | 0.10% | Compare CD Rates |

| 6 Month | $5,000 | 0.20% | Compare CD Rates |

| 12 Month | $5,000 | 0.50% | Compare CD Rates |

| 2 Year | $5,000 | 0.60% | Compare CD Rates |

| 3 Year | $5,000 | 0.70% | Compare CD Rates |

| 4 Year | $5,000 | 0.75% | Compare CD Rates |

| 5 Year | $5,000 | 0.90% | Compare CD Rates |

SBI Corporate Certificates

Similar to its Retail certificates, SBI also offers Corporate certificates with terms ranging from three months to five years. These CDs also require a minimum of $5,000 to open. Strictly for corporate deposits, these certificates additionally allow you to earn at a fixed-rate annual percentage yield (APY). This means that your money will grow at the same rate that you opened your CD with. While market fluctuations typically lead to varying rates, you’ll be locked into the same rate you started with.

| Corporate CD | Minimum Deposit | APY | |

| 3 Month | $5,000 | 0.10% | Compare CD Rates |

| 6 Month | $5,000 | 0.20% | Compare CD Rates |

| 12 Month | $5,000 | 0.25% | Compare CD Rates |

| 2 Year | $5,000 | 0.35% | Compare CD Rates |

| 3 Year | $5,000 | 0.40% | Compare CD Rates |

| 4 Year | $5,000 | 0.45% | Compare CD Rates |

| 5 Year | $5,000 | 0.60% | Compare CD Rates |

SBI Senior Citizen Certificates

The third and final CD rates option SBI offers are its Senior Citizen certificates. These CDs come with relatively shorter terms than the previously listed accounts. In addition, its maturities range from one to five years. Finally, the Senior Citizens CDs also allow users to earn at greater APYs than they would with the same maturities for SBI’s other two account options.

| Senior CD | Minimum Deposit | APY | |

| 12 Month | $5,000 | 0.60% | Compare CD Rates |

| 2 Year | $5,000 | 0.70% | Compare CD Rates |

| 3 Year | $5,000 | 0.80% | Compare CD Rates |

| 4 Year | $5,000 | 0.85% | Compare CD Rates |

| 5 Year | $5,000 | 1.00% | Compare CD Rates |

2-Year Retail CD Interest Rate Comparison

Compare State Bank of India to Other Competitive Offers

Overview of SBI CDs

While most of SBI’s CD terms and rates are generally competitive, you’ll earn greater return with longer terms. In addition, all of SBI’s CD accounts offer great rates, so you’ll typically earn at decent APYs no matter which maturity you choose. Furthermore, all SBI CDs are FDIC-insured up to $250,000.

For withdrawals made on a CD before it reaches maturity, SBI charges early withdrawal penalties. For instance, if you make an early withdrawal on a CD with a maturity of at least five years, you’ll lose 180 days’ worth of interest. However, there’s an easier way for you to continue growing your wealth through a CD. You can do this by having your account automatically renewed. For instance, SBI will automatically renew your account unless you notify them otherwise.

How Much You Earn With SBI Certificate of Deposits Over Time

Though SBI offers high-yield rates, the bank compounds interest quarterly on all CD accounts. Therefore, your wealth won’t build upon itself as fast as it would if it were compounded daily or monthly. However, you’ll still earn at higher APYs with SBI than you would with other competitors. You can basically generate decent return no matter what term you choose. In addition, larger deposits will produce a greater return. However, you’re likely to generate more savings growth if you start with the 12-month maturity mark.

| Initial Deposit | 6-Month CD | 12-Month CD | 60-Month CD |

| $1,000 | $1,001 | $1,005 | $1,045.82 |

| $2,500 | $2,502.50 | $2,512.50 | $2,614.54 |

| $5,000 | $5,005 | $5,025 | $5,229.09 |

| $10,000 | $10,009.99 | $10,050 | $10,458.18 |

How SBI CD Rates Compare to Other Banks’

Though SBI provides highly competitive rates, other competitors like Capital One, also offer similarly high-performing rates when you compare CD rates. Additionally, though solely an online bank, Marcus by Goldman Sachs also generates comparably high interest rates.

While SBI requires a $5,000 minimum deposit, Capital One doesn’t require any for its CDs. In addition, Capital One CD terms range from six to 60 months and compound interest monthly. Furthermore, Capital One allows you to invest in up to 50 CDs simultaneously, while SBI only authorizes you to invest in one.

Marcus by Goldman Sachs also offers similarly competitive rates. For a minimum deposit of $500, you’ll be able to select from a variety of CD terms. Marcus’ longer-term CDs also generate greater returns.

State Bank Of India Fixed Deposit Rates 2020

| CD Account | SBI (Retail) | Capital One | Marcus by Goldman Sachs |

| 6 Month | 0.20% | 0.20% | 0.60% |

| 1 Year | 0.50% | 0.20% | 0.55% |

| 3 Year | 0.70% | 0.30% | 0.55% |

| 5 Year | 0.90% | 0.40% | 0.60% |

State Bank Of India Fixed Deposit Rates

Should You Get a SBI CD Account?

State Bank Of India Fixed Deposit Rates 2018

Overall, if you’re a resident of New York and don’t mind SBI’s $5,000 minimum deposit, you should consider opening one of its CDs. SBI offers highly competitive rates with three different CD account options for its users to select. In addition, each of its CD terms come with high-yield rates, so you can generally earn decent savings growth despite which term you choose.