Structured Deposit

- What Is Structuring In Banking

- Structuring Money Definition

- Structured Deposit Note

- Examples Of Structuring Money

- Structured Deposits Money Laundering

- Structured solutions help you to grow your money without the risk of traditional investments. The deposit has capital-protection. over the fixed term.

- Structured deposits are cash based, fixed term deposits where the return of capital at maturity is not dependent on the performance of the underlying(s). Please take a look at our current range of deposit solutions which are open for subscription.

Important update – Please Read

The notice defines 'structural' (or 'structured') deposits and sets strict distinction between structural deposits and general deposits. It also requires banks to formulate and implement corresponding risk management policies and procedures and put forward accounting and management requirements for structured deposits.

Following the most recent guidance issued by the government in relation to the Coronavirus (Covid-19) we wanted to provide an update regarding how this affects us.

What Is Structuring In Banking

The well-being of staff is our number one priority and we have taken steps to ensure their safety. We have also taken steps to make sure there is minimal disruption to customers and currently have processes in place to deal with your application and any enquiries in the same way as we’ve always done. If you have any questions please email admin@moneyworld.com

Structured deposits are savings accounts where the return is based on the performance of an index.

Normally if the index is higher than it’s starting level on the maturity date you will receive an interest payment. If the index has dropped or stayed the same you would not receive any interest. Your original investment would be returned in full.

Structured deposit products are covered by the Financial Services Compensation Scheme. If the financial institution you have invested with is unable to repay your investment (goes bankrupt or similar) you are entitled to claim £85,000 per person per bank.

Structuring Money Definition

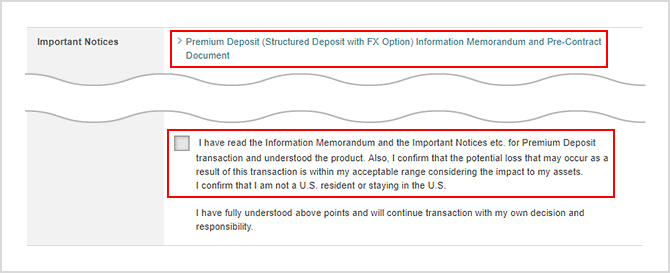

It is very important to fully understand your chosen product. Please go to the products page and read the full brochure before investing. See our Frequently Asked Questions for more details.

We also offer a range of Structured Investment Products that do not guarantee the return of your capital. Potential returns are higher than Structured Deposits due to the additional risk.

0.5% fee on all products

This information will only be used to provide Structured Product updates. Please view our privacy policy for more information.

| Plan name | Closing Date | Counterparty | Taxation | Maximum Term |

|---|---|---|---|---|

| Callable Deposit Plan | 13/04/2021 | Goldman Sachs | Income | 7 years 1 week |

| Plan name | Closing date | Deposit Taker | Taxation | Maximum term |

|---|---|---|---|---|

| FTSE 100 Kick Out Deposit Plan 99 | 01/04/2021 | Investec Bank PLC | Income | 6 years |

| FTSE 100 Defensive Kick Out Deposit Plan 25 | 01/04/2021 | Investec Bank PLC | Income | 6 years |

| FTSE 100 3 Year Deposit Plan 63 | 01/04/2021 | Investec Bank PLC | Income | 3 years |

| FTSE 100 3 Year Defensive Deposit Plan 27 | 01/04/2021 | Investec Bank PLC | Income | 3 years |

| FTSE 100 6 Year Deposit Plan 25 | 01/04/2021 | Investec Bank PLC | Income | 6 years |

| FTSE 100 6 Year Defensive Deposit Plan 35 | 01/04/2021 | Investec Bank PLC | Income | 6 years |

| FTSE 100 Income Deposit Plan 41 - Monthly Option | 01/04/2021 | Investec Bank PLC | Income | 6 years |

** This will be the last issue of Investec Structured Deposits for the foreseeable future.**

| Plan name | Closing date | Counterparty | Taxation | Maximum Term |

|---|---|---|---|---|

| UK Growth Deposit Plan | 29/03/2021 | Barclays Bank plc | Income | 7 years 3 weeks |

| UK Kick Out Deposit Plan | 29/03/2021 | Barclays Bank plc | Income | 7 years 3 weeks |

** MB Structured Investments also have a range of Investment plans available here **

While searching for Chinese New Year fixed deposit promotions, I came across the above promotion advertised. The bank is offering structured deposit that offers up to 12.1% returns over 6 years. It sounds very attractive to me given the high interest rate.

As I am not familiar with structured deposit, I decided to do some further research on it.

What is a structured deposit?

A structured deposit is actually a deposit that is combined with an investment product. The returns on the structured deposit will depend on the performance of the underlying financial asset, product or benchmark.

According to MoneySENSE website, structured deposits can be equity linked, bond linked, interest rate linked or credit linked. There are no further details on the above bank promotion what investment product it is linked with. If you happen to be interested, you should clarify with the banking officer prior to taking up the structured deposit product.

Benefits

- Structured deposits have the potential to offer higher returns compared to traditional fixed deposits.

Structured Deposit Note

Risk

Examples Of Structuring Money

Structured Deposits Money Laundering

- Structured deposits are riskier products than fixed deposits. The returns may be lower than expected.

- Structured deposits are not protected by the Deposit Insurance Scheme. If the bank defaults, we may lose all of our deposit.